Customer Grievance Policy

1.Purpose

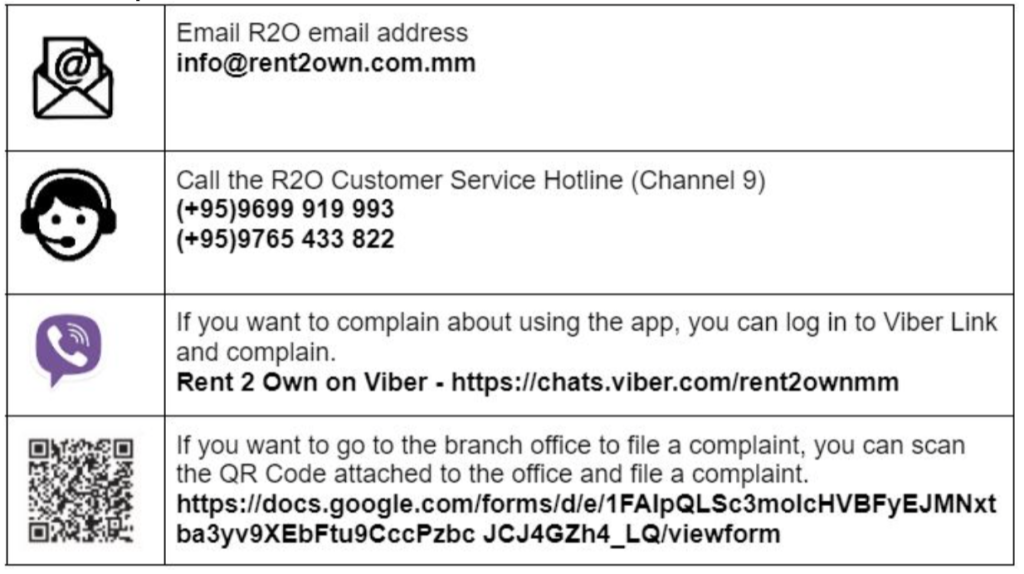

Our Customer Grievance Policy aims to provide you (our customer) with an acceptable process of complaint resolution in a reasonable amount of time. Complaints and disputes can be made by contacting us through the channels and platforms stated on our website from time to time.

2.Complaints Channels

3.Complaints Handling Process

Our staff will handle complaints and disputes according to their training. We will attempt to provide an initial response within 5 business days of the complaint being received. If a complaint is not resolved to your complete satisfaction within 7 business days, it will be put through our internal dispute resolution (IDR) process.

Whilst a complaint is being managed by our IDR process:

- All enforcement activities will be placed on hold. This hold

will continue for 14 days after the dispute is closed or after we provide our

final response to you; - Our staff will, if needed, ask further questions to establish

all relevant facts and to ensure we understand

the issue/s that need to be resolved. - We will also provide you with direct contact details to a

complaint case manager to enable them to follow up on the complaint; and - Our team will contact you with regular updates and ensure that a

record of the dispute is updated accurately.

The maximum time that we take to provide you with an initial response will depend on the types of complaint made:

- If the complaint relates to privacy, we will write to the customer within 7 days to acknowledge the complaint and set out how we will deal with the complaint. We aim to provide you with our final response within 30 days of the complaint being made;

- If the complaint relates to default notices or notices requesting postponement of enforcement proceedings, we aim to provide you with our final response within 7 days of the complaint being made; or

- For all other complaints we aim to provide you with a response within 5 days of the complaint being made.

During the IDR process we may attempt to resolve the complaint by providing you with an offer of resolution. If you accept our offer of resolution, the complaint will be closed once we and you agree and/or the agreed resolution is implemented.

If we cannot resolve a complaint within the relevant time frames above, we will provide you with a final response which may include:

- The final outcome of the complaint at IDR including any

offer of resolution; - Your right to take their complaint to External Dispute Resolution

(EDR); and - If available, the contact details of the EDR scheme that you

can take your complaint to if they are still

dissatisfied with the outcome.

In the event we cannot provide a final response to you within the relevant timeframe we will write to you informing of:

- the reasons for the delay;

- your right to take their complaint to EDR; and

- the contact details of the EDR scheme that you can take your

complaint to if they are still dissatisfied with the outcome.

Details of the EDR scheme include those are listed below:

Changes to our Service

We may, at any time, update our general terms and conditions and /or our services and post these updates on our website. We will use reasonable efforts to give you at least 30 days’ prior notice of the coming into effect of any changes on our website. If a change affects your information obligations or the time for payment, we may notify you directly.

Check contract governing law provision.

If you have any further questions in relation to our Customer Grievance Policy, please contact us by calling ((+95)9699919993) or by sending an email to (info@rent2own.com.mm) and please fill out the link to complaint.

https://docs.google.com/forms/d/e/1FAIpQLSc3moIcHVBFyEJMNxtba3yv9XEbFtu9CccPzbc JCJ4GZh4_LQ/viewform

DATA PRIVACY POLICY STATEMENT

RENT 2 OWN MYANMAR

Dated Last Updated: 12th February 2023

Legal and ESG Department

Contents

1. Introduction

This policy applies to all dealings with, information of the client provided and transactions of the client enter with Rent 2 Own (Myanmar) Company Limited and associates (as such term is defined by the Myanmar Companies Law 2017) (collectively ‘R2O’ and the ‘company’).

The client agrees that R2O, acting individually or collectively, may perform all acts contemplated under this policy. The client agreement and acknowledgement of this policy forms a single agreement with, and is incorporated by reference into, all other agreements the client enters with R2O acting individually or collectively. R2O is committed to protecting the personal and financial information collected and held about the client.

R2O recognise that any personal and financial information collected about the client will only be collected, held, used or disclosed for the purposes R2O have collected it for or as allowed under the law (such as under the Anti-Money Laundering Law 2014 and Regulations, the Law Protecting the Privacy and Security of Citizens 2017 or the Financial Institutions Law 2016 and applicable Regulations). It is important to R2O that the client is confident that any personal and financial information R2O holds about the client will be treated in a way which ensures its protection.

2. Personal and Financial Information

When R2O refers to personal and financial information, R2O means information or an opinion about an identifiable individual, or an individual who is reasonably identifiable. This information may include information or an opinion about the client.

The personal and financial information R2O holds about the client may also include credit-related information.

Credit-related information means:

- credit information, which is information which includes the client identity; the type, terms and

maximum amount of credit provided to the client,

including when that credit was provided and when it was repaid; repayment

history information (information about whether you meet your repayments on

time); default information (including overdue payments); payment information;

new arrangement information; details of any serious credit infringements; court

proceedings information; personal insolvency information and publicly available

information; and - credit eligibility information, which is credit reporting information supplied to R2O by a credit reporting body, and any

information that derives from it.

3. Collection of Personal and Financial Information

The kinds of personal information the client may collect and hold about the client may include the client name, date of birth, address, email address, marital status, number of dependants, occupation, any current loan information, expense details, income details, employer information and any other information R2O made need to identify the client such as the client’s passport, driver’s licence or NRC number.

The main consequences of R2O not collecting personal information are an inability or delay in being able to identify the client, contact or provide services to the client .

R2O will generally not ask the client to disclose sensitive information, such as the client’s religion or health related information. However, sometimes R2O may be required to collect or hold sensitive information about the client or the client may provide unsolicited sensitive information (e.g. if the client volunteers information regarding your health). In those circumstances, you consent for R2O to collect and hold such sensitive information.

4. Electronic collection

R2O will collect information from the client electronically, for instance through internet browsing, mobile or tablet applications, as well as physically.

R2O may use a technology called ‘cookies’ to provide the client with better and more customised service and with a more effective website and mobile application. A ‘cookie’ is a small text file placed on the client computer by R2O web page server. A cookie can later be retrieved by R2O webpage servers. Cookies are frequently used on websites and the client can choose if and how a cookie will be accepted by configuring the client preferences and options in the internet browser.

R2O or its service providers use cookies for different purposes such as:

- to allocate a unique number to the client internet browsers;

- to customize R2O website for the

client; - for statistical and/or behavioural analysis purposes;

- to identify if the client have

accessed a third-party website; and - for security purposes.

In certain circumstances, data collected from use of cookies, pixels, click redirects and tag containers may reasonably identify the client and/or potentially constitute personal or sensitive information. By using R2O website or service, the client consent to use of cookies, pixels, click redirects and/or tag containers and the data collected or disclosed, including to overseas entities.

5. Purposes of collection of personal information

R2O collect the client personal and credit related information so R2O can:

- identify the client and conduct appropriate checks on the client and/ or any security;

- understand the client requirements and provide the client with a product or service;

- set up, administer and manage our products or services, including the management and administration of underwriting, and obtaining loan or lease assessments and credit reports;

- assess the client eligibility to be provided with products or services and

to manage the services R2O provide to the client; - manage,train and develop R2O employees and representatives, and providing continuing employment (in relation to the employees only);

- managing relationship with the client, including debt collection and litigation;

- manage complaints and disputes, and report to regulatory authorities and dispute

resolution bodies; - performing research and statistical analysis, including for customer satisfaction and

product and service improvement purposes. This may include matching information

R2O collects against other information held by third parties. (R2O may also use and disclose de-identified data for these

purposes); - helping R2O tailor existing or develop new products, services or offers which may be offered to the client, and to help R2O selectively target promotional offers and opportunities to theclient needs; and

- developing or seeking to deliver new ranges of products or services.

- search and register security interests on registers in the Republic of the Union of

Myanmar, such as the Directorate of Investment and Company Administration

(DICA).

The client shall only provide with R2O accurate or correct information or omit to provide R2O with information as R2O may not be able to provide the client with R2O services.

Where reasonable and practical R2O will collect the client’s personal information directly. R2O may also collect the client’s personal information from credit reporting bodies, the client bank account providers, our service providers, other credit providers, lead generation businesses, access seekers, finance brokers and third-party social media platforms such as Facebook.

R2O also collects information when the client interacts with the R2O website. For more information, please see R2O website terms of use.

6. Disclosure of information

R2O may disclose the client personal information to third party service providers that the company contract with to perform certain functions on our behalf such as:

- debt collection services;

- any related bodies corporate and/or associates; and

- database providers who collect (sometimes through the use of first-party cookies,

third-party cookies or other third-party identifiers), hold, use and disclose

information in order to assist with identity verification, credit scoring and

credit reporting bodies, debt collectors and lead providers.

R2O may also disclose the client information to:

- any of R2O related bodies

corporate and/or associates; - direct marketers (that is, associated businesses that may want to market products or services to the client). If the client does not wish to receive marketing

information, the client may at any time decline to receive such information by contacting R2O in any of the ways listed at the end of this policy. If the direct marketing is by email the client may also use the unsubscribe function; - anyone who represents the client or anyone to whom the client have consented to the information being disclosed;

- investors,financiers, banks, agents or advisors or any entity that has an interest in, or is considering acquiring an interest in, R2O business or the client contract;

- where R2O is required or permitted to do so by law, such as under the:

- Anti-Money Laundering Law 2014 and Regulations,

- the Law Protecting the Privacy and Security of Citizens 2017, and/or

- the Financial Institutions Law 2016 and applicable Regulations

- companies that provide information and infrastructure systems to us;

- lead generation businesses and other credit providers. R2O may exchange or sell the client information (including personal information and

credit-related information) to third party lead generation companies or other

credit providers who may use that information for any of the purposes for which

R2O can use it. That information may also be disclosed to agents, contractors or advisors of the lead generation business or other credit provider; - online third-party messenger applications, such as Facebook messenger, for the

purposes of contacting the client; - social media platforms, such as Facebook, for marketing related purposes;

- to third parties that assist to enhance R2O business performance and/or the scope and quality of our services to the client such as:

- website behavior analysis providers;

- interest data, remarketing and network impression reporting providers;

- customer,product, business or strategic research and development organisations;

- administration or business management services, consultancy firms, auditors and business management consultants;

- print/mail/digital service providers;

- imaging and document management service;

- search engine optimization service providers;

- credit reporting agencies; and

- to the client employer, referees or identity verification services.

The abovementioned recipients may be located overseas and may store the client’s personal information outside of the Republic of the Union of Myanmar, including in the USA, the European Union and Singapore.

R2O may use cloud storage to store the personal information the company holds about the client. The cloud storage and the IT servers may be located in or outside the Republic of the Union of Myanmar.

7. Testimonials

R2O may publish testimonials, comments or feedback the client provides to R2O on the website, which may contain personal information such as the client’s first name and suburb. If the client wants to remove the personal information that is being displayed on the R2O website, please send a request to R2O at the contact details below.

8. Credit-related information

R2O may collect and hold credit-related information and exchange this information with credit reporting bodies and other entities.

This credit-related information may be held by R2O in electronic form on our IT servers and may also be held in paper form. R2O may use cloud storage to store the credit-related information about the client and the IT servers may be located in or outside the Republic of the Union of Myanmar.

When R2O obtains credit eligibility information from a credit reporting body about the client, R2O may also seek publicly available information and information about any serious credit infringement that the client may have committed. R2O may disclose the client credit-related information to entities that provide support functions to R2O. These entities may be located overseas, including in the USA, the European Union and Singapore.

9. Credit reporting bodies

The client credit-related information may be exchanged with credit reporting bodies. Credit reporting bodies include credit-related information in reports to assist credit providers assess the client credit worthiness, assess the client application for products or services and to manage the client services.

If the client fails to meet payment obligations in relation to any product or service that R2O has provided or the client has committed a serious financial infringement, then R2O may disclose this information to a credit reporting body.

Sometimes the client credit-related information will be used by credit reporting bodies for the purposes of ‘pre-screening’ credit offers on the request of other credit providers. The client should contact the credit reporting body to advise them if the client believes that the client may have been a victim of fraud.

10. Other data collection

R2O use information technology tools to improve the client user experience of R2O website, products and services and to better understand the client behaviour and devices (such as a device’s IP address (captured and stored only in anonymised form), device screen size, device type (unique device identifiers), browser information and geographic location (country only). These features collect data via advertising cookies, code and identifiers.

R2O will not use this information to identify individual users or to match it with further data on an individual user.

11. Security of Information

R2O will take reasonable steps to protect the client’s personal information by storing it in a secure environment. R2O may store the client’s personal information in paper and electronic form. R2O will also take reasonable steps to protect any personal information from misuse, loss and unauthorised access, modification or disclosure.

12. Updating your personal information

It is important to the company that the personal information held about the client is accurate and up to date. During the course of the relationship with the client, R2O may ask the client to inform if any of the personal information has changed.

If the client wishes to make any changes to personal information, the client may contact R2O and R2O will generally rely on the client to ensure the information held about the client is accurate or complete.

13. Access and correction to your information

R2O will provide the client with access to the personal information that the company holds about the client. The client may request access to any of the personal information that the company holds about the client at that time by contacting R2O on the details provided below.

Depending on the type of request that the client makes, R2O may respond to the client request immediately, otherwise R2O usually responds within 7 days of receiving the client request. R2O may need to contact other entities to properly investigate the request.

There may be situations where R2O are not required to provide the client with access to the client personal information, for example, if the information relates to existing or anticipated legal proceedings, or if the client request is frivolous. An explanation will be provided to the client, if R2O denies access to the personal and financial information that R2O holds about.

If any of the personal information that R2O holds about the client is incorrect, inaccurate or out of date , the client may request to correct the information by contacting in any of the ways listed at the end of this policy. If R2O refuses to correct personal information, the client will be provided with the reasons for not correcting the information.

14. Using government identifiers

If R2O collects government identifiers, such as the client NRC number or passport number or driver’s licence number, R2O does not use or disclose this information other than as required or permitted by law. R2O may use government identifiers to verify the identity when the client deals with the company.

15. Business without identifying you

In most circumstances, it will be necessary for R2O to identify the client in order to successfully do business, including answering general inquiries about the company product or services or current promotional offers, however depending on the circumstances R2O may in some instances do business with the client without providing personal information. However, the extent of the information and services that the company may be able to provide will be limited.

16. Complaints

If the client is dissatisfied with how the company has dealt with the personal information, or the client has a complaint, the client can contact the company complaints channels in any of the ways listed at the end of this policy.

17. Further information

The client may request further information or provide feedback on the way the company manages the client’s personal and financial (including credit-related) information by contacting us.

18. Changes to our privacy policy

R2O may change this policy from time to time. Any updated versions of this policy will be posted on the website and will be effective from the date of posting.

19. Action taken to the employee

In response to data privacy concerns and to safeguard client information, R2O has implemented strict action protocols for employees found to be abusing or mishandling client data. These measurements include rigorous internal investigations, immediate suspension pending investigations and if necessary termination of employment by following HR policy. Additionally, the company continuously educates the staff on data privacy best practices and enforce regular reviews of the company data security policies to ensure a safe and confidential environment for the clients; sensitive information and also whistleblower mechanism and regular security assessment is in practice.

20. Contact Details

For privacy related queries, complaints, or any other requests, you can contact us using any of the following methods:

Email: info@rent2own.com.mm

Phone number: (+95)9669919993 , (+95)9765 433 822

Rent2own Viber : https://chats.viber.com/rent2ownm

QR Code to Complaint : https://docs.google.com/…/1FAIpQLSc3moIcHVBFyE…/viewform

This policy was last updated 12th February 2023.

ANTI-MONEY LAUNDERING AND COUNTER TERRORISM FINANCING POLICY

Legal Department

Final Last updated: February 2021

Contents

| 1 | POLICY STATEMENT | 3 |

| 2 | DEFINITIONS | 4 |

| 3 | ‘STANDARD’ AND ‘ENHANCED’ DUE DILIGENCE | 6 |

| 4 | DUE DILIGENCE ON OWNERS OF NON-NATURAL PERSONS | 8 |

| 5 | INTERNAL RISK MANAGEMENT AND MONITORING | 9 |

| 6 | THIRD PARTY RELIANCE | 11 |

| 7 | ANONYMOUS ACCOUNTS FORBIDDEN | 11 |

| 8 | RECORD KEEPING | 11 |

| 9 | DUTY TO REPORT | 12 |

| 10 | AML/CTF EMPLOYEE TRAINING PROGRAM | 13 |

1. POLICY STATEMENT

Rent 2 Own (R2O) is committed to fully comply with all applicable laws and regulations regarding anti-money laundering and counter terrorism financing (“AML/CTF”). R2O has adopted and will enforce within its activities the provisions set forth in the Anti-Money Laundering Laws & Regulations in order to prevent and detect money laundering, terrorist financing and other illegal activities.

This Policy Statement is designed to assist all clients and Employees in adhering to R2O’s policy and procedures, which, if followed diligently, are designed to protect themselves, R2O, its Employees, its facilities and its activities from money laundering or other illegal activities.

If R2O, its personnel and/or premises are inadvertently used for money laundering (“ML”), financing of terrorism (“FT”) or other illegal activities, R2O can be subject to potentially serious civil and/or criminal penalties. Therefore, it is imperative that every member, officer, director, and employee (each, an “Employee”) is familiar with and complies with the policy and procedures set forth in this document.

To ensure that the R2O’s policies and procedures are adhered to, R2O shall designate an AML/CTF compliance officer. R2O also maintains an anti-fraud function specifically tasked to identify suspicious transactions and manage the blacklist of individuals to mitigate the risks associated with such listed individuals becoming clients, Employees or customers of R2O. The designated compliance officer is responsible for training Employees on matters related to compliance with AML/CTF Laws & Regulations and reporting of infringements (or potential infringements) to senior management of R2O.

As at

the date of this policy update, a credit bureau is not operating in the

Republic of the Union of Myanmar.

2. DEFINITIONS

“AML/CTF Laws & Regulations” means the laws and regulations applicable for the time being in the Republic of the Union of Myanmar, including:

- AML Act No. 24 / 2015

- AML Order No.45 / 2019

- AML Notification No. 1201/2015

- Counter

Terrorism Law No.23,2014 - Counter

Financing of Terrorism Rules dated 11 September Notification No. 1202/2015

“Compliance Officer” means the compliance officer R2O shall designate at a management level. R2O shall ensure the following powers to the officer appointed:

- Power to access any documents, records, registers and accounts

necessary for the performance of his tasks; and - Power to request and access any information, notice, explanation

or document from any Employee of R2O.

“Counter Financing of Terrorism Laws & Regulations” means the Counter Terrorism Law dated 4 June 2014

(The Pyidaungsu Hluttaw Law) No.23, 2014 and the Counter Financing of Terrorism Rules dated 11 September Notification No. 1202/2015;

“CDD” means customer due diligence;

“Domestic and foreign politically exposed person” means a person who is prominent or has been entrusted with public functions within the country or in any foreign country and family members or close associates of such persons;

“Family Book” or a “Household List” is a document with information (NRC number, date of birth, gender, nationality, occupation, address) on the members of the family or household. This document is given by MoLIP (Ministry of Labour, Immigration and Population) after the head of the household applies in person for it at the MoLIP Township Office. The letter must be countersigned by the Ward/Village Administrator and this can be used as a proof of address.

“Financing of Terrorism” means dealing with or transferring unlawfully the funds by any means with the intention that they should be used or in the knowledge that they are to be used, in full or in part, directly or indirectly by any terrorist or any terrorist group or concealing, moving abroad or transferring to other’s name an asset knowingly or with reason to know that it is stored or maintained or controlled by a terrorist group or a terrorist or any other person on behalf of them or any attempt, assistance or organizing others to commit any of the aforementioned.

“International politically exposed person” means a director, a deputy director, a member of the board of directors and a senior member of an international organization, a member who has the similar position or a person who has been entrusted with such function and family members or close associates of such persons;

“Money laundering” means the commission of any of the following:

- Conversion or transfer of money and property from the proceeds of

crime disguising or concealing the illicit origin of the money or property or

of helping any person who is involved in an offence to evade the legal

consequences; - Acquisition, possession or use of money and property, knowing or

having reason to know, at the time of receipt, that such money and property are

the proceeds of crime; - Participation in,

association with, aiding, abetting, facilitating, managing, counseling or being

a member of an organized group to commit or attempt to commit any of the above; - The laundering of money and property derived may include:

- Participating, abetting, supporting, providing, managing, advising

and being a member of an organized criminal group by organized criminal group; - From offences (such as relating to terrorism and financing of

terrorism, trafficking in humans and migrant smuggling, narcotic drugs and psychotropic substances,

trafficking of stolen and other illicit goods, corruption, fraud, counterfeit

money or goods, murder or causing grievous bodily harm, kidnapping, illegal

restraint and taking hostage, sexual exploitation including sexual exploitation

of children; infringement of the Intellectual Property Right, counterfeit

goods, robbery or theft, environmental

crime, smuggling, extortion, forgery, to tax evasion and other tax crimes,

piracy, terrorism, insider trading to get illicit profits by a person who is

the first to know the information by using the said information himself or

providing it to another person and market manipulation, any offence punishable

with imprisonment for a term of a minimum of one year and above under any existing

law of the State, offences prescribed by

the Union Government that are applicable to this Law by notification from time

to time, laundering money and property in Myanmar that is derived from

committing an offence abroad);

“Ward or Village recommendation letter” is the recommendation of the customer’s residency from the ward/village administrator.

3. ‘STANDARD’ AND ‘ENHANCED’ DUE DILIGENCE

- Types of due diligence:

R2O shall conduct the following types of due diligence:

- FIRSTLY, conduct ‘Standard’

Due Diligence measures;- SECONDLY, if the

customer is NOT identified as low risk, conduct ‘enhanced’ Due Diligence

measures consistent with the identified risk, determining the extent of the

activities which are unusual or suspicious;

- SECONDLY, if the

- Standard Due Diligence

Timing:- Standard Due Diligence measures on the

customer shall be conducted before carrying out transactions for a customer, or

before opening an account or establishing a relationship;

- Standard Due Diligence measures on the

- Enhanced Due Diligence

Timing:

Enhanced Due Diligence measures on the customer shall be conducted at each of the following times and situations:

- When Standard due

diligence procedures determine that the customer is not low risk; - Before carrying out a

transaction for a customer with R2O above the threshold amount of USD 15000 or equivalent amount in

any currency or as from time to time defined conducted as a single transaction

or several connected transactions; - Before carrying out or

accepting receipt of a domestic and international wire or electronic transfer

for a customer; - When there is doubt

about the veracity or adequacy of the customer identification data on record; - When there is suspicion

that it is linked to money laundering or terrorist financing; and/or - If the anti-fraud

department notifies of fraud, potential fraud or that the individual is

blacklisted. - Standard Due Diligence Measures and Process:

Standard due diligence measures and process shall be undertaken as follows:

- Collecting the

following information for Know-Your-Client purposes:- name in full (including

other names); - National Registration

Card, Citizen Scrutiny Card, Passport; - Permanent address and

contact address; - Date of birth;

- Nationality;

- Occupation;

- Phone number (if any);

- Photograph

identification; - 2 (two) introducer names

and accounts (such as the existing current account).

- name in full (including

- Collecting the

information above using independent and reliable independent sources, documents

and data. Accordingly, Know-Your-Client

documentation that must be collected and must include at least the following:- NRC (National Registration Card)

- Customer’s

photograph - Family

Book - Ward

/ Village Recommendation Letter.

- Collecting information

on and understanding the purpose and intended nature of the business

relationship and the purpose of

utilizing the product. - Collecting information on the

source of income and expenses with consent to calculate the cash flow statement

of each customer. - The sales agents collecting the

information and documentation for a client application must do so at a point of

sale before the underwriting procedure commences. This information is entered into the company

system and verified by the centralized underwriting team based in the head

office in Yangon. - Enhanced Due Diligence Measures:

Enhanced due diligence measures shall be undertaken as follows:

- Verify if the customer

is acting on behalf of another person, company, organization or legal person; - Obtain information on

suspicions such as: customer’s name, the details of any ultimate beneficiary of

the transaction which is not the customer; - If a customer or a

beneficial owner is suspected of being a ‘domestic and foreign politically

exposed person’ or an ‘international politically exposed person’: - Seek prior consent from senior management before establishing or

continuing a business relationship; - Take all appropriate measures to identify the wealth and source of

funds; - Apply the requirements for all types of politically exposed

persons to their family members and close associates. - Utilizing resources such as social

media (Viber, Facebook) with consent to obtain independent information to

recheck the validity of customer’s information that is provided.

4. DUE DILIGENCE ON OWNERS OF NON-NATURAL PERSONS

If R2O is conducting due diligence on non-natural persons, R2O shall conduct due diligence on the owners of the customer and take reasonable measures to verify the identity of such persons, based on the following information:

- For a legal person:

- Identity of the natural persons if any as an ownership interest

can be so diversified that there are non-natural persons exercising control of

the legal person or arrangement through ownership who ultimately have a

controlling ownership; - To the extent that there is doubt under the above sub-article as

to whether the person(s) with the controlling owner / owner(s) or where

non-natural person exerts control through ownership interests, the identity of

the natural persons if a person or arrangement through other means; - Where a non-natural person is identified under the above

sub-articles, R2O should identify and verify the identity of the relevant

natural person who holds the position of senior managing official.

- Identity of the natural persons if any as an ownership interest

- For non-natural person legal arrangements:

- Trusts – the identity of the settlor, the trustee(s), the

protector (if any), the beneficiaries or class of beneficiaries, and any

ultimate effective control over the trust including through a chain of control/

ownership; - Other types of legal arrangements – the identity of persons in

equivalent or similar positions.

- Trusts – the identity of the settlor, the trustee(s), the

5. INTERNAL RISK MANAGEMENT AND MONITORING

- R2O

shall adopt, develop and implement internal programs, policies, procedures

(as necessary) and controls for the implementation of this policy

statement and for managing effectively to mitigate the risks identified. - R2O

must monitor the implementation of such policies and controls and enhance

them, if necessary. In such policies and controls, the following shall be

included: - Customer due diligence

measures, ongoing due diligence, monitoring the transactions, reporting

obligations and record keeping obligations - Procedures to ensure

high standard of integrity of its employees and a system to evaluate the

personal, employment and financial history of these employees; - Ongoing Training Programs

for employees to assist with regard to know-your-customer, specific

responsibilities of anti-money laundering and countering the financing of

terrorism and the transactions which are required to report contained in

chapter VIII; - An independent audit function to check in

compliance with and effectiveness of the measures taken action in execution of

this Law; - R2O shall identify and

assess money laundering and terrorist financing risks that arise from new and

existing activities or technologies, including delivery channels, and take

necessary action to manage and mitigate such risks - In the case of new products and delivery

channels the risk assessment should take prior to the launch of the new

products, business practices or the use of new or developing practices; - R2O shall identify and

assess the risks of money laundering and financing of terrorism that may arise

in relation to new products, services, business or technologies and take

appropriate measures to manage and mitigate such risks; - Transactions shall be

closely examined to ensure that they are consistent with their knowledge of

their customer, commercial activities and risk profile and if necessary, source

of funds; - R2O shall exercise ongoing customer due

diligence measures with respect to each business relationship. - Types of measures to take action shall be determined for each of

the requirements contained in this policy.

In this determination, the size of business activities, regions, customers,

transactions, products, services and delivery channel and scope, geographic and

country coverage of the business activities shall be concluded together with

the risk of money laundering and financing of terrorism - R2O processes must:

- Apply

the policies and controls issued under this Policy Statement on a group-wide

basis including all branches and majority owned subsidiaries (if any) - Have information sharing procedures within the financial group for

the purposes of carrying out customer due diligence measures and managing the

risks of money laundering and financing of terrorism, including procedures to

safeguard use of information and sharing.

E. R2O must monitor for:

- All complex, unusual,

large transactions or unusual patterns of transactions that have no apparent or

visible economic or lawful purpose; - Any business

relationship or transaction with a person from or in a country which does not

apply sufficient measures to prevent money laundering and financing of

terrorism; and

F. R2O shall examine the background and purposes of transaction or business relationships contained from the above as far as possible, and the findings shall be recorded in writing.

6. THIRD PARTY RELIANCE

R2O may rely on a third party which has capacity to perform the following elements among the customer due diligence measures:

- Obtain all information, without delay;

- Make available identification data and other documents relating to

customer due diligence measures without delay if it is requested; - Satisfy the maintenance, supervision or monitor and assessment for

compliance with the requirements, on behalf of itself;

- Make available identification data and other documents relating to

BUT the identification and verification of the customer is the main duty of R2O.

7. ANONYMOUS ACCOUNTS FORBIDDEN

R2O shall be prohibited from keeping anonymous accounts or accounts in obviously fictitious names.

8. RECORD KEEPING

- R2O

shall maintain records of the following information and ensure that the

records and underlying information are readily available to the senior

management and other competent authorities and the records should be

sufficient for the reconstruction of individual transactions:

(a) Documentation, records obtained through customer due diligence process and documents obtained from scrutiny including accounts of customer or beneficial owner and business correspondence for at least five years after the business relationship has been terminated or the occasional transaction has been carried out;

(b) Records of transactions in both domestic and international, attempted or executed for five years after the transaction has been carried out;

(c) Copies of transaction reports submitted under the Law and other related documents for at least five years after the report was submitted to Senior Management;

(d) Risk assessment and other underlying information after that has completed or has updated for a period exceeding five years;

- R2O

shall keep documents, data or information collected under this section

including data especially relating to money laundering and financing of

terrorism, high risk customers and business relationships up-to-date and

relevant.

9. DUTY TO REPORT

- R2O employees shall promptly report to its senior management if

the amount of transaction of money or property is equal to or exceeds the

designated threshold or it has reasonable ground to believe that any money or

property is obtained by illegal means or is related to money laundering or

financing of terrorism or attempt to do so. - R2O employees shall not disclose any report or relevant

information and any measure to any person other than among other Employees,

external legal counsel and/or appropriate public authorities. - R2O Employees shall report to senior management any cash

transaction in an amount which is equal to or exceeds USD 15,000 by a single

transaction or several transactions that appear to be linked. - R2O employees shall carry out the risk assessment of money laundering

and financing of terrorism according to the laws applicable in Republic of the

Union of Myanmar. The risk assessment

and any underlying evidence and information shall be recorded in writing, be

kept up-to-date and be readily available to the relevant authorities.

10. AML/CTF EMPLOYEE TRAINING PROGRAM

- As part of the R2O’s AML/CTF program, all Employees are expected to be fully aware of the AML/CTF policy statement and procedures.

- Each Employee is required to read and comply with this policy statement and procedures, address concerns to the compliance officer.

- To ensure the continued adherence to R2O’s AML/CTF policy statement and procedures, all Employees are required to confirm their awareness of the contents of this document by signing an acknowledgement form annually, or more frequently, as required by the compliance officer.

- All Employees are required:

- at a time specified by the Compliance officer, to undertake training programs on Anti-money laundering policy statement policy and procedures;

- to get trained in how to recognize and deal with transactions which may be related to money laundering;

- to timely escalate and report the matter to the Compliance Officer;

- to get themselves acquainted with AML/CTF Laws & Regulations;

- to comply with the requirements of all R2O Anti-money laundering policy statement procedures and rules;

- to prevent, detect and report to the Compliance Officer all potential instances in which R2O or its employees, its facilities or its activities have been or are about to be used for money laundering, terrorist financing and other legal activities;

- to attend anti-money laundering training sessions, so that all such Employees are aware of their responsibilities under R2O’s policies and procedures; and as affected by current developments with respect to anti-money laundering events.

5. R2O must comply exactly with the directives issued by the senior management.